Key Takeaways

1. Michael Milken: A Visionary Driven by Contradictions

Respected, catered to, deferred to, even revered—Michael Milken had it all. What was missing? What went wrong?

A childhood prodigy, Milken was raised in comfort, showered with love and admiration, and excelled in every endeavor. He was a math whiz from an early age, helping his accountant father with taxes at ten, and later became a successful student and popular figure, even serving as prom king and head cheerleader. This early success fostered a belief that his world would be as straightforward and predictable as his family life.

Driven by ambition, Milken aimed to be a millionaire by thirty, a goal he achieved by stepping closer to the edge than his cautious father. He saw money as a byproduct of useful work, a means to an end, not an end in itself. However, his unexamined compulsion to do every possible piece of business, coupled with a deep-seated need to please and avoid confrontation, would eventually lead him into high-stakes, high-risk situations.

His greatest strength, a non-judgmental approach and a desire to help others, became his fatal flaw. He believed in giving anonymously and praising others, but this philosophy proved ill-suited for the cutthroat world of Wall Street and the public scrutiny that followed. His inability to say "no" and his constant drive to solve everyone's problems, even when it meant bending rules, ultimately made him vulnerable.

2. Junk Bonds: Democratizing Capital, Challenging the Elite

At Berkeley in 1967, Milken had an insight that would, in time, support an entire firm, overthrow conventional wisdom, and put a great many outsiders in executive offices—the bond services' seal of approval was less than accurate.

Milken's groundbreaking insight came from W. Braddock Hickman's study, which suggested that a carefully chosen portfolio of low-grade bonds outperformed higher-rated ones, even through the Depression. He realized that traditional bond rating services focused too much on past performance and not enough on cash flow or intangible factors like ambitious management. This led him to believe that these "fallen angels" were undervalued and offered immense potential.

This new approach challenged the conventional wisdom of Wall Street, which had long dismissed non-investment-grade bonds as "junk." Milken saw an opportunity to democratize capital, providing financing to small and mid-sized businesses, many of which were overlooked by established institutions. His vision was to empower "upstarts and outsiders" who couldn't access traditional funding, aligning with his belief in improving society through finance.

Drexel Burnham Lambert, under Milken's leadership, built an inventory and customer base for these high-yield bonds, quickly becoming the dominant force in this market. The immense profitability of these deals, with Drexel charging significantly higher fees than for high-grade bonds, initially deterred competitors, leaving the field clear for Milken to build his empire and revolutionize corporate finance.

3. The "Highly Confident" Letter: A Symbol of Drexel's Aggression

The real bottom line on the "highly confident" letter was that it rivaled bridge loans for the distinction of being remembered as the most boneheaded, shortsighted, counterproductive financing device of the 1980s.

Born from a brainstorming session in 1983, the "highly confident" letter was Leon Black's idea to finance unsolicited acquisitions, or hostile takeovers, using junk bonds. It was a non-binding expression of faith in Milken's ability to raise capital, designed to give commercial banks the courage to support deals that traditional financing wouldn't touch. This innovation allowed smaller companies to acquire larger ones, using the target company's own assets as collateral.

This aggressive tactic quickly became a symbol of Drexel's power and Milken's influence, striking terror into corporate boardrooms and forcing restructurings and mass layoffs. While it generated enormous fees and profits for Drexel, it also alienated the American Establishment, creating a "holy war" between "predator and prey." Milken himself later found the phrase "highly confident" repugnant, recognizing its arrogance and the negative image it projected.

The letter's impact was profound, but ultimately detrimental to Drexel's long-term standing. It stripped the intellectual content from the complex issue of hostile takeovers, fueling public resentment and galvanizing opposition from Congress and rival firms. This "stroke of genius" in financial engineering proved to be a catastrophic blunder in public relations, making Drexel a pariah and setting the stage for its eventual downfall.

4. Ivan Boesky: The Deceitful Informant and His Sweetheart Deal

If wisdom about finance and a beguiling veneer don't account for Boesky's success, a lack of conscience does. Boesky lied. He had no problem with lying. He was adept at it—Boesky, lying, attracted more positive attention than more talented men who told the truth.

Ivan Boesky was a master manipulator, driven by a craving for mass acclaim and wealth, often at the expense of others. He presented himself as a devout Jew and philanthropist while engaging in blatant criminal activities and personal deceptions, including multiple extramarital affairs and bankrolling his lifestyle with his wife's fortune. His employees described him as a "raving maniac" when successful, only becoming tolerable in adversity.

His "sweetheart deal" with the SEC and U.S. Attorney's office was a testament to his ability to deceive. In exchange for a lifetime ban from securities and a $100 million fine (partially a tax write-off and paid in depreciating stock), he was allowed to sell off positions in an "orderly fashion" (federally approved insider trading) and only plead guilty to a single felony count. Crucially, the government made no independent investigation of his finances, accepting his claim of negative net worth.

Boesky's cooperation was primarily motivated by self-preservation, not contrition. He promised damaging testimony against Michael Milken and others, becoming an undercover agent to secure a lenient sentence. However, his testimony in later trials proved unreliable, marked by selective memory and inconsistencies, leading defense lawyers to label him "a pile of human garbage." His true financial state and the extent of his hidden assets, such as those potentially held in shell companies like Cobalt Holdings, remained largely unexamined by the prosecution.

5. Rudy Giuliani: The Ambitious Prosecutor and RICO's Power

RICO was a perfect weapon to bring Milken and Drexel to their knees. There was only one problem—no U.S. attorney anywhere had ever used RICO against a securities firm.

Rudolph Giuliani, a prosecutor with political aspirations, saw rooting out political corruption as his defining mission, famously stating, "I don't think there's anything worse than a public official who sells his office, except maybe for a murderer." His career was marked by a relentless drive for convictions and a keen understanding of media presence, using his office as a "pulpit" to send messages to society.

Initially dismissive of Wall Street crime, Giuliani's focus shifted dramatically with the Boesky revelations. He embraced the Racketeer Influenced and Corrupt Organizations Act (RICO), a draconian law designed for organized crime, as his "Stradivarius." RICO allowed prosecutors to charge any business as a "racketeering enterprise" based on two "predicate acts" over a ten-year period, leading to astronomical financial penalties and asset forfeiture even before conviction.

The Princeton/Newport case became Giuliani's dry run for using RICO against a securities firm. Despite defense arguments that the alleged tax trades were common practice, Giuliani's office pursued RICO charges, leading to the firm's collapse and sending a clear message to Wall Street: cooperate or be destroyed. This aggressive use of RICO, coupled with Giuliani's political timeline (he was eyeing a mayoral run), intensified the pressure on Drexel and Milken, making a settlement almost inevitable.

6. Milken's Defense: A Battle Against Perception and Betrayal

For Mike, contemplating Boesky was an invitation to see the faces of Lori and the kids. And not in some pleasant family portrait—if he had to consider what he had done with Ivan, he imagined his family, weeping and brokenhearted, as he was led away in chains.

Milken's initial defense strategy was rooted in his unwavering belief in his innocence and his family's well-being. He saw himself as a victim of a political agenda, a "martyr" being persecuted for challenging the Establishment. His lawyers, including Edward Bennett Williams and Arthur Liman, aimed to fight the government in court, confident that Milken's legitimate business practices and lack of personal gain from the alleged crimes would prevail.

The psychological toll of the investigation was immense. Milken, who had always avoided confrontation and public scrutiny, found himself constantly under attack. Every negative article, every press leak, and every defection from his inner circle chipped away at his resolve. His family became his "strength" and "proof of his innocence," leading him to an illogical leap: if he would never hurt them, he must have done nothing wrong.

Despite his lawyers' efforts, Milken's non-confrontational nature and his inability to fully grasp the legal and public relations battle hindered his defense. He resisted revealing himself publicly, clung to the idea of anonymous philanthropy, and struggled to articulate his case in a way that resonated with outsiders. The constant pressure, coupled with the perceived betrayal by Drexel and former colleagues who became government witnesses, ultimately pushed him towards a plea bargain, a decision he would later deeply regret.

7. The Fatico Hearing: A Microcosm of the Prosecution's Weaknesses

If Fatico had only been about the three transactions that the prosecutors had selected for the hearings, the government would have suffered a resounding defeat.

The Fatico hearing, ordered by Judge Kimba Wood to gain "insight into defendant's character" before sentencing, became a crucial battleground. The government presented three transactions—Wickes, Storer, and Caesars World—to demonstrate Milken's alleged additional wrongdoing beyond his plea. However, the prosecution's case was significantly weakened by unreliable witnesses and a lack of direct evidence linking Milken to the alleged crimes.

Witness credibility was a major issue. Gary Maultasch, granted immunity, gave equivocal testimony regarding the Wickes manipulation, shifting blame to another trader and failing to directly implicate Milken. Peter Gardiner, an admitted perjurer, claimed Milken pointed to his screen and said "Wickes, six and one eighth," but his memory was inconsistent, and his prior lies undermined his testimony. Richard Grassgreen, Kindercare's portfolio manager, a confessed thief from his own company, was deemed incredible by Judge Wood when he claimed to have asked Milken if Kindercare, not him, should buy Storer warrants.

The government's insider trading claims in the Caesars World case also faltered. Jim Dahl, another immunized witness, alleged Milken traded on inside information, but his testimony was contradicted by contemporaneous client notes. The prosecution's overall presentation was heavy on atmospherics and accusations of "obstruction of justice" (an uncharged offense), but light on concrete evidence directly tying Milken to the specific criminal acts beyond his plea.

8. Obstruction of Justice: The Uncharged Crime that Sealed Milken's Fate

Michael Milken's pattern of wrongdoing, as shown in the crimes to which he pled guilty, is to step just over the line into unlawful conduct, and to do so in a way that preserves his 'deniability' and minimizes the risk of detection.

Despite the government's struggles to prove specific instances of insider trading or manipulation at the Fatico hearing, Judge Wood found Milken guilty of obstruction of justice, an uncharged offense. This conclusion was based on the testimony of Terren Peizer and Jim Dahl, whom Wood found "forthrightly, carefully, and credibly," despite their own credibility issues and inconsistencies.

Peizer's testimony, though riddled with factual errors (e.g., misidentifying Milken's handwriting, faulty memory of events), was crucial. He claimed Milken opened an empty desk drawer and made a cryptic suggestion to destroy evidence, which Wood interpreted as a "subtle message." Dahl's account of a "bathroom conversation" where Milken allegedly signaled the advisability of removing or destroying documents further solidified this impression.

Wood's interpretation of these "clandestine and subtle messages" was critical. She viewed Milken's actions as characteristic of his operating style: stepping just over the line while preserving deniability. This finding, though not a formal charge, significantly influenced her sentencing decision, highlighting a pattern of conduct that she believed warranted severe punishment, regardless of the direct evidence for the specific transactions presented.

9. The Sentencing: A Symbol of Public Outrage, Not Proportional Justice

Good! The greedy bastard got his.

On November 21, 1990, Judge Kimba Wood delivered a sentence that shocked the courtroom and resonated with public sentiment: ten years in prison (two years on each of five counts, served consecutively), plus eighteen hundred hours of community service a year for three years. This was a far harsher sentence than anticipated, especially compared to Ivan Boesky's lighter penalty, and was widely seen as a symbolic punishment for the "excesses of the 1980s."

Wood's rationale emphasized deterrence, retribution, and rehabilitation. She dismissed arguments that Milken's crimes were merely "technical" or that he didn't personally profit, stating that his offenses were "hard to detect" and warranted greater punishment. She also rejected the idea of community service as a sole punishment, despite Milken's extensive philanthropic work, which she acknowledged began before the investigation.

The public reaction was largely one of satisfaction, reflecting a widespread belief that Milken, the "$550-million-a-year man," was responsible for the era's financial woes, including the S&L crisis. The sentence, though disproportionate to the economic damage found by the court ($318,000), cemented Milken's image as the "biggest criminal in the history of Wall Street," a villain three times guiltier than Boesky, despite the government's inability to prove major insider trading charges.

10. The Irony of Vindication: Junk Bonds Endure, Milken Remains Scapegoat

In the end, the thing they were attacking was the only thing that stood up.

Despite Milken's downfall, the junk bond market experienced a remarkable recovery in the early 1990s, with high-yield funds outperforming other bond investments. This vindication of his core business philosophy stood in stark contrast to the narrative of "financial euphoria" and "Ponzi schemes" that had been propagated during his prosecution. Ironically, firms like Salomon Brothers, once his fiercest rivals, became major players in the junk bond market.

The legal landscape also shifted, with appellate courts overturning RICO convictions in cases like Princeton/Newport and Mulheren, suggesting that the government's aggressive tactics had overreached. The SEC, under Richard Breeden, later issued mild penalties for widespread brokerage firm misconduct, and the Federal Reserve Board eased restrictions on banks investing in junk bonds, further highlighting the disproportionate treatment Milken received.

Milken, however, remained a scapegoat. Despite settling civil suits for an additional $500 million and being allowed to oversee the sale of his remaining assets from prison, he continued to face relentless criticism and legal challenges. His attempts to explain his actions and highlight his philanthropic contributions were often dismissed or misinterpreted, leaving him trapped in a public image he felt was fundamentally untrue. The enduring irony was that the very financial innovation he championed, and for which he was so severely punished, ultimately proved its value to the American economy.

Last updated:

Review Summary

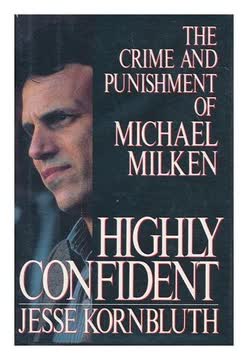

Highly Confident presents Jesse Kornbluth's sympathetic portrait of Michael Milken, the 1980s junk bond king, based on extensive interviews with Milken, his family, and associates. Reviews note the author's positive perspective on Milken's prosecution, highlighting his remarkable trading record and reluctance to speak publicly. The book explores Milken's passive stance on hostile takeovers despite opposing them, his global ambitions, and his plea bargain decision. Kornbluth suggests prosecutors may have overreached in their pursuit, comparing their excess to the era's Wall Street culture.